Mortgage stress, what is it?

While the term itself has no concrete definition, it is widely accepted that mortgage stress occurs when 30% or more of your pre-tax income is going towards your monthly mortgage repayments. This is based on affordability guidelines from the ’80s and ’90s, and has proven to be a reliable way of diagnosing mortgage stress.

With Australian interest rates being at record lows and a rising property market where, more often than not, people are paying $1 million dollars or more, could we be setting ourselves up for mortgage stress and potentially a massive property crash if people can’t afford their mortgage payments or are unable to deal with the stress it is causing?

Are you in mortgage stress?

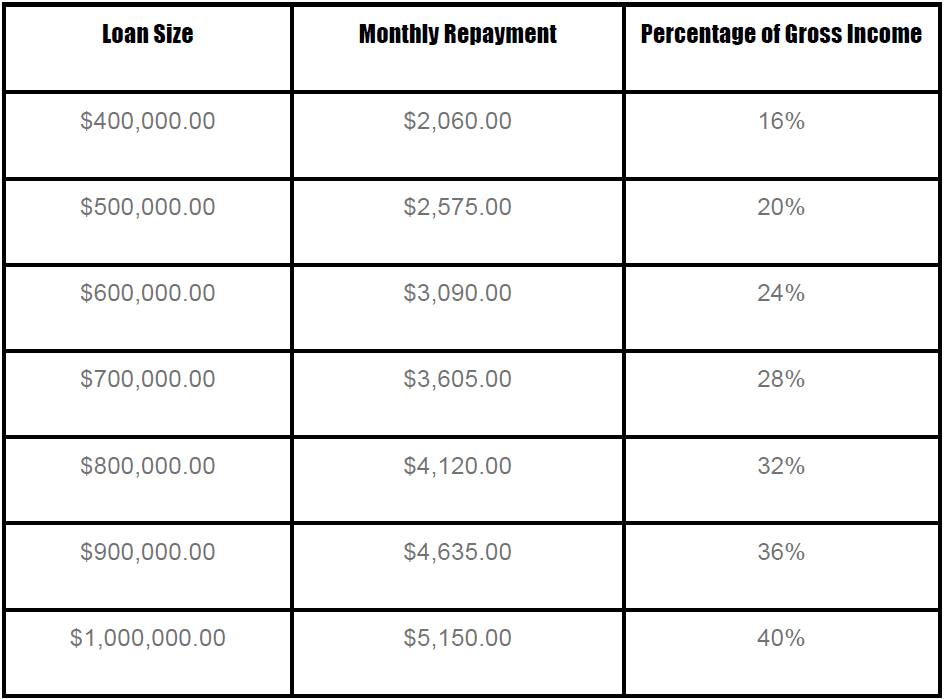

Based on ABS statistics, a household with earnings around $12,600 per month gross, and a mortgage of $700,000.00 would be starting to show the signs of mortgage stress. These figures are based on a standard variable rate of 4.64% over a 30 year term.

Take this Quick Mortgage Stress Test

- Does more than 30% of your pre-tax salary to go to your monthly home loan repayment?

- Have you had to convert your home loan to interest-only in order to reduce the monthly burden?

- Do you struggle to find enough money to pay your utility bills?

- Are you relying more and more on your credit card(s)?

- Are you only making the minimum payment on your credit card(s)?

- Do you regret buying that fancy car with the balloon payment at the end of the lease?

- Is your relationship is suffering because of financial pressures?

If you answered ‘yes’ to the majority of these questions, then you are experiencing Mortgage Stress. Mortgage Stress can, and does, impact your quality of life. Having to watch every penny, stressing over every bill, constantly worrying whether or not you are going to have enough money to cover everything is no way to live.

So, here’s the real question – Is having that more expensive home or investment property really worth the while?

The ups and downs of interest rates

The current official cash rate of 1.50% is the lowest in our history and gives real estate agents ammunition to spruik their favourite catchphrase ‘There’s never been a better time to buy’. The Reserve Bank tells us the cash rate has averaged 4.95% from 1990 until 2016, reaching an all-time high of 17.5% in January of 1990 and a record low of 1.50% right now.

Of course, the interest rates we pay for loans are higher than the official cash rate. CANSTAR analysis has calculated that the average advertised variable home loan rate over the past ten years (based on the Big 4) has been 7.13%. Canstar’s database now shows there are plenty of low rate home loans in the marketplace, more than 100 of them with advertised rates under 4%.

However if you need interest rates to be this low in order to afford your home or investment property, then you will definitely struggle if and when interest rates rise.

In my opinion, rather than taking on more debt in this low interest rate environment, it is the perfect time to consolidate your mortgage position, and make extra payments to buffer yourself should anything happen in your life further down the track. Our home loan repayment calculator allows you to play around with different ‘what if’ scenarios when you key in your own individual figures.

A mortgage is generally taken out over 30 years, when interest rates will fluctuate many times, often without warning. I think it is financial sense to err on the safe side in the beginning rather than, based on low interest rates, extending yourself to the extreme.

Mortgage stress can impact every nook and cranny of your life. Just because you can borrow the money does not mean you should. One curveball in your life could cause you to lose everything, including your family.

Declan Hanratty – Managing Director

M: 0409 089 456 F: 03 9416 1916 ABN: 19 880 907 430 POSTAL: PO Box 1551 COLLINGWOOD Victoria 3066 MFAA Membership No. 50217 Australian Credit Licence No. 383120 Credit Ombudsman Service No. 412201